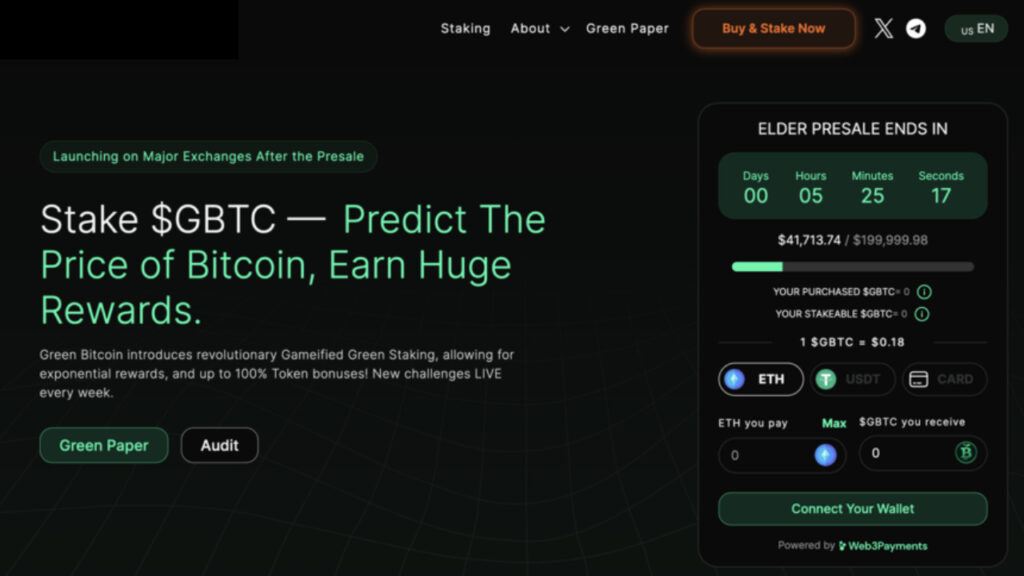

Whenever a new crypto project is to be launched, the developers always roll out a batch of tokens for interested investors. This process is called crypto presale. Crypto presales have become increasingly popular in the world of cryptocurrency investments.

These presales allow investors to purchase tokens or coins before they are available to the general public or before they become available on cryptocurrency exchanges. In some cases, investors can receive significant discounts on the tokens during the presale phase.

During a crypto presale, investors purchase tokens or coins directly from the project team or developers. This differs from a traditional Initial Coin Offering (ICO), where tokens are sold to the public through a crowdfunding campaign.

The goal of a presale is to raise funds for the project in its early stages and to generate interest in the token before it is released to the public.

What are the different Types of Crypto Presale?

When it comes to crypto presales, there are two types of presales:

- Investor-only token sale: This is only available to major investors who initially want to invest in a new cryptocurrency venture. These can be pricey, but they also give investors access to special incentives like discounts or bonuses unavailable during regular token sales.

- Open to everyone: The second kind of presale allows retail buyers to purchase a token before it goes public. A majority of tokens are sold during a public sale.

Investing in a crypto presale can be a promising opportunity for investors to get in on the ground floor of a potentially game-changing project.

However, it is important to thoroughly research the project and the team behind it before investing. With the potential for high returns, investing in a crypto presale can be a rocket to success for those who choose wisely.

Let’s see what the benefits and risks of crypto presale are.

What are the benefits of crypto presales or buying crypto in the presale stage?

The main advantage of buying a new cryptocurrency during its presale phase for investors is getting a better deal on the asset. Additionally, it may enable you to acquire a portion of the currency’s total supply, increasing the value of your holdings in the event that demand rises and more people start using the currency.

But keep in mind that investing at the presale stage has significant risks. You could lose all of your money if something goes wrong with a presale campaign—an announcement is postponed or doesn’t happen as expected. When the currency is launched on a well-known exchange like Binance, Huobi, or Coinbase, investing at the presale stage ensures a profit—sometimes large gains.

Historically, cryptocurrencies such as Ethereum, Ripple, and Cryptonite could have been bought at the presale stage for $0.001 per coin during the ICO phase and later increased to $2.50 or more within two months of their launch on an exchange.

What are the risks involved in crypto presales?

Investing in presales carries inherent risks, including the potential for project failure, regulatory issues, and market volatility.

Every month, dozens of new cryptocurrencies enter the market, but the majority will never be extensively used. That implies that they might ultimately lose all of their worth.

There is also no guarantee that you will be able to swap cryptocurrencies for other currencies or goods and services, except for well-known cryptocurrencies like Bitcoin and Ether.

Another characteristic of cryptocurrencies is volatility, which refers to how quickly their value can rise or fall. You might buy crypto during a presale and see the value pop before falling to a price less than what you paid.

Since cryptocurrencies are traded on unregulated platforms, they don’t offer protections like those afforded by brokers or centralized exchanges.